Stocks continue to tumble as Wall Street ramps up selling in response to heightened fears about slowing economic growth. The S&P 500 hit new 52-week lows on Monday. In fact, the benchmark index is now trading at its lowest levels since November 2020, with a recession more likely as the U.S. Federal Reserve and major central banks around the world lift interest rates to fight soaring inflation.

The Fed and Jay Powell are poised to do all they can to drag prices down and are willing to cause economic pain to do so. The Fed’s 0.75% hike last week and its efforts in November and December are expected to lift the Fed Funds rate to between 4.25% and 4.5% by the end of 2022.

The Fed’s aggressive actions and outlook, coupled with a flight to safety from investors around the globe have sent both the 10-year and the 2-year U.S. Treasuries to levels last seen during the financial crisis. Yields on the 10-year surged to around 3.9% Monday, up from 3.5% at the market’s mid-June lows and 1.6% in early 2022. The 2-year is floating at 4.4%, up from 0.80% at the start of 2022 and 0.30% this time last year.

Higher rates impact equities markets in a variety of ways. Elevated yields make safe investments such as bonds more attractive, while lowering what investors are willing to pay for risk in the form of valuation multiples, and more.

The higher interest rates have already dramatically cooled off the housing market and crushed growth-focused stocks. Plus, the overall outlook for S&P 500 earnings is already trending heavily in the wrong direction, as higher rates and higher prices cool economic activity and eat into growth and profits.

Image Source: Zacks Investment Research

The fact that substantially lower growth is already showing up in the earnings outlook and interest rates are responding to the Fed’s hawkish stance can be viewed as positives for longer-term investors looking to find solid entry points into strong stocks. Now it is impossible to call a market bottom in real-time and stocks could continue to slide.

Thankfully, investors with long-term horizons shouldn’t be afraid to start small positions in blue-chip stocks amid the economic headwinds. The U.S. will bounce back and economic activity continues even during recessions. And always remember that many people are most excited to buy stocks near the market top and afraid to buy at what turns out, in retrospect, to be the lows.

Here are two blue-chip stocks that investors might want to consider adding to their long-term portfolios as the market falls to new 52-week lows.

Intuit Inc. INTU

Intuit’s growing portfolio includes online tax help giant TurboTax, alongside accounting software, small business money management tools, personal finance offerings, and more. Intuit spent the last several years expanding its portfolio even more through two major acquisitions. INTU bought personal-finance portal Credit Karma in December 2020 and email-marketing standout Mailchimp last November.

The addition of Mailchimp, which also provides digital ad services and customer-relationship-management tools, expands Intuit’s reach into brand new pockets of the economy. The diversified portfolio helps Intuit package more offerings to its small and mid-sized business clients and grow its customer base. Intuit now boasts over 100 customers worldwide.

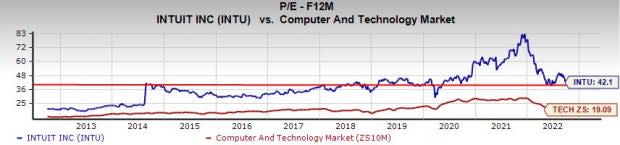

Image Source: Zacks Investment Research

Intuit consistently grew its sales over the last 20+ years, with only two small YoY declines. This run includes sales growth between 11% and 32% over the last seven fiscal years. The firm’s adjusted FY22 earnings (period ended July 31) climbed 22% on 32% stronger sales (24% excluding Mailchimp). INTU’s FY23 and FY24 estimates have held up well since its August 23 release as its management teams remains bullish.

Zacks estimates call for Intuit’s sales to climb 14% in FY23 and 13% next year to help lift its adjusted earnings by 16% and 15%, respectively. The growth outlook highlights how crucial Intuit’s portfolio remains in the face of a wide-ranging economic downturn. INTU’s earnings estimates have held up well for it to grab a Zacks Rank #3 (Hold).

Intuit hasn’t stayed above the selling, which has hit growth-focused firms particularly hard. INTU shares have tumbled 45% below their 2021 peaks. But the stock is still up 175% over the last five years to crush the Zacks Tech sector’s 55% and 575% during the last decade.

The heavy selling, mixed with its strong earnings outlook, has recalibrated its valuation in a big way. Intuit is still trading at a significant premium to the tech sector at 42.1X forward 12-month earnings vs. 19.1X. But this puts INTU near its own 10-year median.

Image Source: Zacks Investment Research

Intuit’s tax and other software offerings are set to remain vital during periods of both economic expansion and contraction. The company has a strong balance sheet and pays a dividend, which it recently raised by 15%. INTU also approved another $2 billion in share buybacks to up its current authorization to $3.5 billion.

Intuit stock trades 50% below its current Zacks consensus price target. And Wall Street remains extremely bullish on the stock, with 16 of the 17 brokerage recommendations Zacks has accumulated at “Strong Buys.” Therefore, investors might want to consider starting a position in the diversified software stock despite the economic turbulence.

Mastercard Incorporated MA

Mastercardis a consumer and business credit card powerhouse that operates an elaborate backend processing network. On top of its core credit card segment, MA is actively diversifying to help transform the firm into a financial technology titan designed to thrive in a digital payments economy alongside the likes of Block SQ, the big Wall Street banks, and countless upstarts.

Some of Mastercard’s newer efforts include cryptocurrency, buy now, pay later offerings, and other endeavors focused on the future of a mostly digital transaction-based economy. Mastercard’s core credit card segment remains strong, with it travel-focused cross-border segment thriving despite economic downturn fears. The company topped our second quarter EPS and sales estimates at the end of July, as “overall consumer spending remained robust.”

Image Source: Zacks Investment Research

Mastercard provided upbeat guidance at the time because people continue to spend heavily despite 40-year high inflation. It is also vital to remember that higher-income customers account for a large chunk of retail spending, and they are being impacted far less by 8% inflation. In fact, Mastercard managed to up its outlook for FY22 last quarter, with inflationary pressures “yet to significantly impact overall consumer spending.”

Mastercard’s 2021 revenue surged 23% to outpace its pre-pandemic totals by $2 billion. Meanwhile, its adjusted FY21 earnings climbed 31%. Zacks estimates call for 18% sales expansion in 2022 and over 16% higher revenue in FY23 to reach $25.89 billion. Mastercard’s adjusted EPS are expected to surge 27% this year and another 19% in 2023.

Image Source: Zacks Investment Research

Mastercard’s ability to grow its sales and earnings by double the inflation rate is outstanding. And it’s only failed to beat our EPS estimates once in the last five years. The company raised its quarterly dividend by 11% last year and it still has $6.7 billion left on its share current repurchase plan. Mastercard currently lands a Zacks Rank #3 (Hold) and 12 of the 17 brokerage recommendations Zacks has are “Strong Buys” with three more “Buys,” and two “Holds.”

Mastercard shares had held up better than many other growth-heavy stocks in 2022 until they plummeted alongside most of the market in the middle of August. MA shares are down around 20% since August 15 to close regular trading Monday at $290 per share. These levels offer 42% upside to Mastercard’s current Zacks consensus price target.

The recent downturn has readjusted Mastercard’s valuation, with MA now trading near its covid lows at 24.2X forward 12-month earnings. MA’s forward P/E marks a 25% discount to its own five-year median and 10% vs. its decade-long median. The stock is trading at these levels even though Mastercard shares are still up 110% over the last five years and 1,800% in the past 15 years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

I'm an expert in financial markets and investment strategies, having spent years analyzing market trends and economic indicators. My depth of knowledge extends to understanding the intricate dynamics that drive stock prices, economic growth, and central bank policies.

Now, let's delve into the concepts mentioned in the article. The central theme revolves around the current state of the stock market, influenced by the U.S. Federal Reserve's actions and concerns about economic growth. Here are the key concepts:

-

Stock Market Decline:

- The article highlights the ongoing decline in stock prices, particularly focusing on the S&P 500 reaching new 52-week lows.

- Wall Street's increased selling is attributed to fears of slowing economic growth.

-

Federal Reserve's Actions:

- The U.S. Federal Reserve is mentioned as a significant player in the market downturn.

- The Fed is actively raising interest rates (0.75% hike last week), aiming to combat soaring inflation.

- The article suggests a hawkish stance by the Fed, willing to cause economic pain to control prices.

-

Impact of Higher Interest Rates:

- Higher interest rates are discussed, impacting various aspects of the market.

- Elevated yields make safe investments like bonds more attractive.

- The article notes the effect on valuation multiples and investor willingness to take risks.

-

Treasury Yields:

- Both the 10-year and 2-year U.S. Treasuries are highlighted, reaching levels last seen during the financial crisis.

- Yields on the 10-year surged to around 3.9%, impacting the market.

-

Economic Impact:

- Higher interest rates have already cooled off the housing market and affected growth-focused stocks.

- The overall outlook for S&P 500 earnings is seen as trending negatively due to higher rates and prices impacting economic activity.

-

Investor Strategies:

- The article suggests that lower growth in earnings and the Fed's actions can be viewed positively by longer-term investors.

- Encourages investors with long-term horizons to consider starting small positions in blue-chip stocks amid economic headwinds.

-

Blue-Chip Stock Recommendations:

- Two specific blue-chip stocks are recommended for long-term portfolios:

- Intuit Inc. (INTU): A diversified software company with a growing portfolio, strong sales history, and positive growth outlook.

- Mastercard Incorporated (MA): A consumer and business credit card powerhouse diversifying into financial technology, with impressive sales and earnings growth.

- Two specific blue-chip stocks are recommended for long-term portfolios:

-

Stock Valuations:

- The article discusses the recalibration of stock valuations, with specific reference to Intuit trading at a premium to the tech sector and Mastercard's recent downturn adjusting its valuation.

In summary, the article provides a comprehensive analysis of the current market conditions, focusing on the interplay between central bank actions, interest rates, and the impact on various sectors and individual stocks.